Automated Material Handling Equipment Market by Product (Autonomous Mobile Robots, Cobot Palletizers, Automated Storage & Retrieval Systems, Conveyors Systems, Warehouse Management System, Automated Guided Vehicles), Region - Global Forecast to 2029

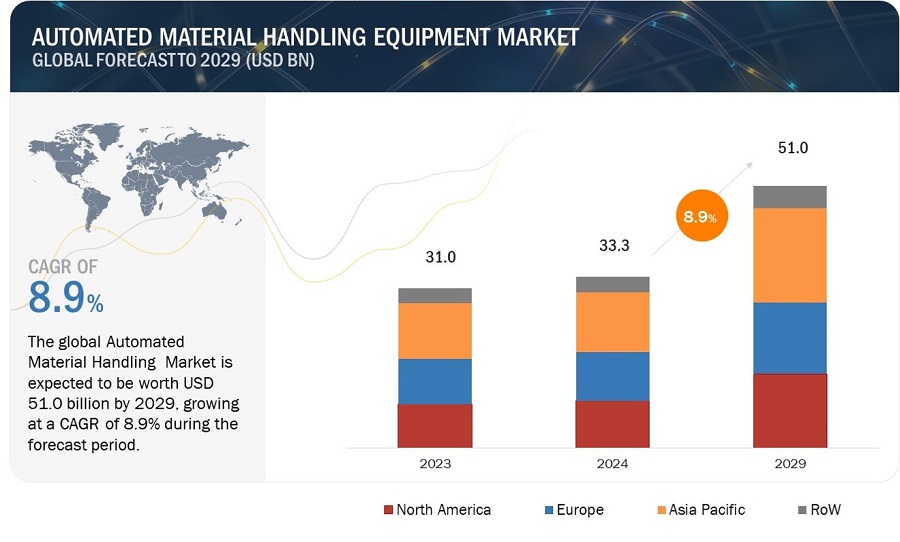

[365 Pages Report] The global Automated Material Handling Equipment market size is foreseen to grow from USD 33.3 billion in 2024 to USD 51.0 billion by 2029, at a CAGR of 8.9% from 2024 to 2029. The market growth is expected to be fuelled by various factors, including the increasing number of startups offering robotic solutions for warehouse automation, the growing popularity of automated material handling equipment among leading industries, and rising concerns regarding labour costs and safety. The expanding intralogistics sector in Southeast Asia presents promising growth opportunities, along with potential prospects in the healthcare industry. Integration with IoT and data analytics, as well as the demand for lean manufacturing and Just-In-Time (JIT) practices, contribute to the market's expansion. Challenges such as the high upfront cost of automated material handling equipment for SMEs, coupled with high integration and switching costs, pose constraints on market growth. The unavailability of technical expertise and a skilled workforce to handle system operations may hinder the adoption and implementation of automated solutions in various industries.

Automated Material Handling Equipment Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Demand for lean manufacturing and Just-in-Time (JIT) practices

Lean Manufacturing and JIT principles aim to minimize waste, reduce lead times, and optimize processes. Automated material handling equipment streamlines workflows, allowing for faster and more efficient material flow throughout the production or distribution facility. This efficiency improvement aligns well with the goals of Lean Manufacturing and JIT, driving the adoption of automated material handling equipment. JIT practices emphasize maintaining minimal inventory levels and replenishing stock only when needed. Automated material handling equipment systems facilitate precise inventory management by accurately tracking stock levels, enabling companies to minimize excess inventory and avoid stockouts. This capability ensures that materials and components are readily available when required for production, contributing to JIT objectives. Lean Manufacturing focuses on eliminating non-value-added activities and optimizing value stream processes. Automated material handling equipment automates repetitive and manual tasks, reducing the need for human intervention in material handling processes. By minimizing non-value-added activities such as material transportation and handling, they contribute to overall process efficiency and cost reduction. JIT practices emphasize producing goods of consistent quality to meet customer requirements. Automated material handling systems help ensure product quality by reducing the risk of errors, damage, and contamination during material handling and processing. By maintaining quality standards and minimizing defects, automated material handling equipment supports the JIT objective of delivering defect-free products to customers.

Restraint: Integration complexities

Integrating automated material handling equipment with existing Warehouse Management Systems (WMS) and other operational software can be complex and require customization. Existing warehouse management systems and automated material handling equipment systems might have different data formats or communication protocols. Reconciling these discrepancies requires effort and expertise.

Many warehouses have a variety of software systems in place to manage different aspects of operations, including WMS, Enterprise Resource Planning (ERP), Inventory Management Systems, and Transportation Management Systems (TMS). Integrating AMHE with these diverse systems requires compatibility and seamless communication between them. Also, every warehouse has its unique processes, workflows, and requirements. Off-the-shelf solutions may not fully meet the specific needs of a particular warehouse operation. Customization is often necessary to ensure that the AMHE integrates smoothly with existing software and aligns with the warehouse's operational workflows. Integrating AMHE with existing software systems may also require ensuring compatibility with the hardware components of the automated equipment. This includes interfaces with sensors, controllers, and other hardware devices to enable seamless communication and control. Parallelly, compliance with regulatory requirements, such as data privacy laws and industry standards, adds another layer of complexity to integration efforts. Ensuring that the integrated system meets all regulatory obligations is essential to avoid compliance issues and potential legal consequences.

Opportunity: Integration with loT and data analytics

By integrating AMHE with IoT devices such as sensors and actuators, companies can monitor the performance, status, and condition of equipment in real-time. This allows for proactive maintenance, predictive analytics, and optimization of material handling processes to minimize downtime and maximize efficiency. IoT-enabled AMHE systems can collect and analyze data on equipment health and performance metrics, such as temperature, vibration, and energy consumption. Predictive maintenance algorithms use this data to anticipate potential failures and schedule maintenance tasks before they occur, reducing the risk of unplanned downtime and costly repairs.

Data analytics platforms enable AMHE providers to analyze vast amounts of operational data collected from equipment, sensors, and other sources. By applying advanced analytics techniques such as machine learning and artificial intelligence, companies can identify patterns, trends, and inefficiencies in material handling processes. This insight enables continuous process improvement and optimization to enhance productivity and reduce operational costs. Also, integration with IoT and data analytics allows for greater visibility and transparency across the supply chain. AMHE systems can track the movement of materials, inventory levels, and order status in real-time, providing stakeholders with actionable insights into supply chain performance. This visibility enables better decision-making, improved inventory management, and enhanced customer service.

IoT-enabled AMHE systems can be remotely monitored and controlled from anywhere with an internet connection. This capability enables managers and operators to access equipment status, performance metrics, and diagnostic information from mobile devices or computers. Remote monitoring facilitates proactive decision-making, troubleshooting, and response to issues, even when personnel are off-site. By harnessing the power of data analytics, AMHE providers can offer value-added services such as predictive analytics, performance benchmarking, and optimization recommendations to their customers. These data-driven insights help businesses make informed decisions, improve operational efficiency, and stay ahead of competition in an increasingly data-driven marketplace. Integration with IoT and data analytics enables AMHE providers to offer customized solutions tailored to the specific needs and requirements of their customers. By analyzing data from equipment usage, material flow, and process performance, companies can design and implement automated material handling systems that optimize workflows, maximize throughput, and meet unique business objectives. Thus, the integration of AMHE with IoT and data analytics offers opportunities to enhance operational efficiency, reduce costs, and drive innovation in material handling processes. By leveraging real-time data insights, predictive analytics, and remote monitoring capabilities, companies can unlock new levels of productivity and competitiveness in the evolving landscape of automated material handling.

Challenge: Technical challenges related to sensing elements

The real-time technical challenges related to any sensing element in material handling equipment could stop the entire process. For instance, an AGV will not react to commands effectively if the sensing element of the AGV is not equipped correctly. The failure of the sensor in this system would halt the entire process. Moreover, any error or bug in the control software may lead to improper functioning of AGVs; this could delay the entire production process. Mechanical failures can result from improper maintenance, causing loss of production and performance. Similarly, regular maintenance is crucial for the smooth functioning of ASRS, conveyors & sortation systems, and cranes. As all automated material handling equipment are fitted with sensors to operate effortlessly and automatically, technical challenges related to sensors in automated material handling equipment pose a challenge for the market’s growth.

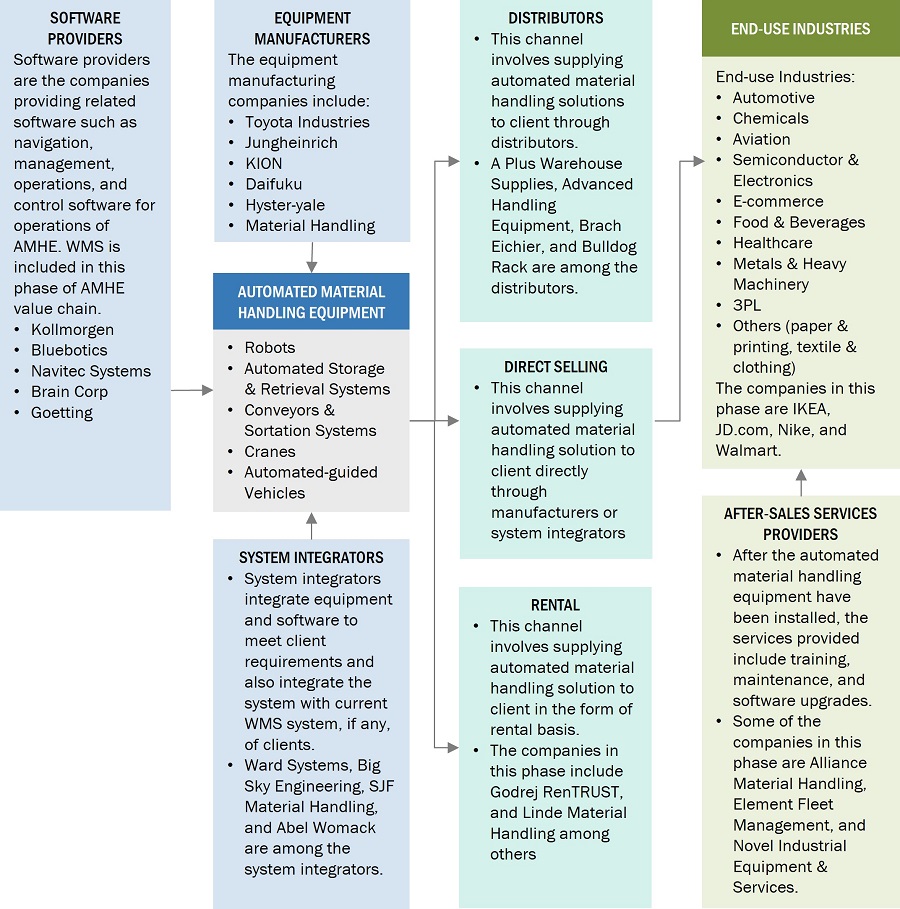

Automated Material Handling Market Ecosystem

Daifuku Co, Ltd. (Japan), KION GROUP AG (Germany), SSI SCHAEFER (Germany), TOYOTA INDUSTRIES CORPORATION (Japan) and HONEYWELL INTERNATIONAL INC. (US) are the key players in the Automated

Material Handling Equipment market globally. These companies not only boast a comprehensive product portfolio but also have a strong geographic footprint.

WMS to grow at the highest CAGR during the forecast period.

These systems serve as vital assets in fine-tuning warehouse operations, adeptly managing inventory, orchestrating workflows, and fostering seamless coordination across supply chain elements. Their functionalities span from effective inventory tracking and efficient order fulfilment to real-time monitoring, rendering them indispensable in modern warehouse management practices. The surge in automation adoption and the exponential growth of e-commerce, coupled with the pressing need for heightened efficiency and precision in inventory control, are fuelling the demand for WMS across a spectrum of industries, including retail, manufacturing, and logistics. As enterprises endeavour to streamline their operations and adapt to evolving consumer dynamics, WMS emerge as pivotal facilitators of enhanced productivity and competitive edge within the automated material handling sector.

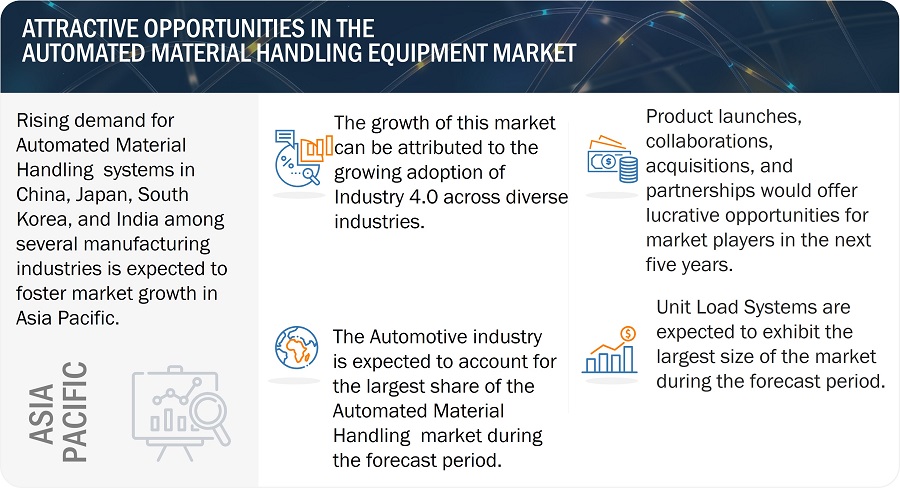

The market for Automotive Industry is expected to account for largest market share during the forecast period.

During the forecast period, the automotive industry is expected to hold the highest market share in the automated material handling equipment market. Automated material handling equipment is critical to automotive manufacturers' ability to maximise production, increase productivity, and guarantee smooth logistics operations. These solutions cover a broad range of technology, specifically designed to address the demands of automotive assembly lines and warehouses, such as robotic arms, conveyor systems, palletizers, and automated guided vehicles (AGVs). The automobile industry is driving demand for highly automated material handling solutions through its pursuit of lean manufacturing principles and growing integration of Industry 4.0 technologies. The automotive industry places great importance on automated material handling technology, which is becoming a crucial component of production and logistics strategies as companies aim to reduce downtime, optimise operations, and meet changing market needs.

Unit Load Material Handling to account for the largest share of the Automated Material Handling Equipment market market during 2024-2029.

Unit Load Material Handling is projected to hold the most market share in automated material handling equipment between 2024 and 2029. Pallets, containers, and totes are among the different kinds of equipment included in this category that are intended to handle loads either as individual units or combined loads. Unit load material handling solutions are critical to maximising storage capacity, optimising warehouse operations, and enabling effective products transit within manufacturing and distribution centres. Palletizers, conveyors, automated storage and retrieval systems (ASRS), and robotic systems designed to satisfy various industry demands are just a few of the technologies they cover The demand for unit load material handling equipment is fuelled by the widespread adoption of automation, which is being driven by factors like rising labour costs, the need for higher throughput, and the emphasis on operational efficiency. These industries include retail, e-commerce, food and beverage, and automotive. Unit load material handling solutions become critical components of productivity and competitiveness in the automated material handling market as companies want to improve supply chain agility and satisfy changing customer demands.

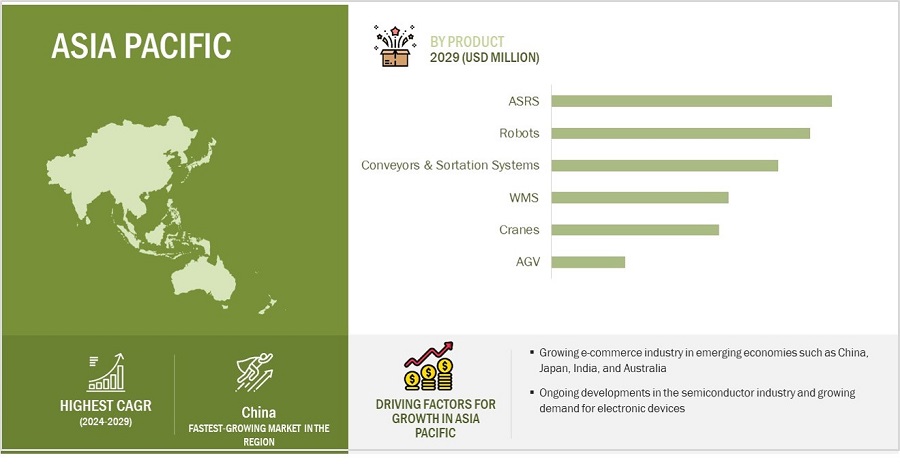

Asia Pacific to account for the largest share of the Automated Material Handling equipment market during the forecast period.

The market for automated material handling equipment is dominated by Asia Pacific due to the region's strong economic growth and broad adoption of automation solutions in a variety of industries. The demand for automated material handling equipment has increased dramatically as a result of the Asia Pacific region's economies expanding quickly, especially in industries like manufacturing, shipping, e-commerce, and the automotive sector. The proliferation of production facilities in many industries such as consumer products, electronics, and automotive has resulted in a notable increase in demand for effective material handling solutions. The increased emphasis on raising supply chain management procedures, cutting labour expenses, and increasing operational efficiency is what's driving this trend even further. The adoption of automated material handling systems in warehouses and distribution centres throughout the region has been fuelled by the growth of e-commerce and the rising demand for prompt and precise order fulfilment.

The need for automated material handling equipment is being driven by infrastructure development projects, such as the building of new seaports, airports, and logistics centres, which will simplify transportation and cargo handling processes. The region's dominance in the market for automated material handling equipment is partly due to the growing automobile industries in nations like South Korea, Japan, and China. Asia Pacific is expected to remain the market leader for automated material handling equipment for the whole of the forecast period due to the region's continuous fast industrialization, urbanisation.

Automated Material Handling Equipment Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Automated Material Handling Equipment Companies players have implemented various types of organic as well as inorganic growth strategies, such as product launches, product developments, partnerships, and acquisitions to strengthen their offerings in the market. Daifuku Co. Ltd. (Japan), KION Group AG (Germany), SSI SCHAEFER (Germany), TOYOTA INDUSTRIES CORPORATION (Japan) and Honeywell International Inc. (US) are the key players in the Automated Material Handling Equipment market globally.

The study includes an in-depth competitive analysis of these key players in the Automated Material Handling Equipment market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years Considered |

2020–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD Million/ Billion) |

|

Segments Covered |

Product, Industry, System Type and Region |

|

Regions covered |

North America, Asia Pacific, Europe, and Rest of the World |

|

Companies covered |

Daifuku Co, Ltd. (Japan), KION GROUP AG (Germany), SSI SCHAEFER (Germany), TOYOTA INDUSTRIES CORPORATION (Japan) and HONEYWELL INTERNATIONAL INC. (US) . |

Automated Material Handling Equipment Market Highlights

In this report, the overall Automated Material Handling Equipment market has been segmented based on product, industry, system type and region.

|

Segment |

Subsegment |

|

By Product |

|

|

By System Type |

|

|

By Industry |

|

|

By Region |

|

Recent Developments

- In March 2024, SSI SCHAEFER introduced a new software solution designed specifically for the independent operation of the SSI LOGIMAT Vertical Lift Module. Known as LOGIONE, this software offers a straightforward and user-friendly storage location and article management system. With intuitive user interfaces, operators are supported seamlessly, eliminating the necessity for extensive training.

- In November 2023, KION Group AG introduced its own fuel cell systems tailored for its industrial trucks. This leading global intralogistics firm engineered a 24-volt System specifically designed for warehouse trucks. The company’s Hamburg plant inaugurated a new production, line capable of manufacturing up to 5,000 fuel cell systems annually.

- In October 2023, Toyota Material Handling Japan (TMHJ), a division of Toyota Industries Corporation, innovated the MEGALORE power storage system, which reuses ENELORE Lithium-lon Batteries (LIBs) for electric lift trucks. This initiative facilitated the establishment of a circular system for lift truck LiBs and promotes the extensive adoption of storage batteries. By reutilizing batteries that have reached their replacement age in stationary storage systems, TMH addressed the growing demand for such solutions in recent years.

- In September 2023, Daifuku Co., Ltd. announced that it decided to pursue a merger by absorption of its wholly owned subsidiary Iwasaki Seisakusho Co., Ltd. Iwasaki Seisakusho became part of the Daifuku Group in April 2012 through the acquisition of 100% of its outstanding shares by the Daifuku Co., Ltd..

- In May 2023, SSI SCHAEFER introduced a cutting-edge fully, automated piece picking system known as the SSI Piece Picking application. This adaptable solution, accompanied by specialized intelligent software, incorporates a range of innovative features, including pick-and-place functionality artificial intelligence driven object recognition, patented gripping point determination, and exceptionally delicate product handling capabilities.

Key Questions Addressed by the Report

Who are the key players in the Automated Material Handling Equipment market? What are the major growth strategies they have taken to strengthen their position in the market?

Daifuku Co, Ltd. (Japan), KION GROUP AG (Germany), SSI SCHAEFER (Germany), TOYOTA INDUSTRIES CORPORATION (Japan) and HONEYWELL INTERNATIONAL INC. (US) are the key players in the Automated

Material Handling Equipment market globally. These companies offer a wide portfolio for Automated Material Handling Equipment with global presence across various countries to meet the requirements of customers. Strategies such as acquisitions, product launches, collaborations, agreements and contracts were adopted by these companies to withstand the competitive landscape of this market.

What are the new opportunities for emerging players in the Automated Material Handling Equipment value chain?

Leading Automated Material Handling Equipment companies have an opportunity to solidify their dominance. To fortify their leadership position, automated material handling companies can focus on innovating advanced equipment like AGVs, ASRS, conveyors, and robots, prioritizing seamless integration with emerging technologies and robust data management functionalities. By investing in software solutions tailored specifically for automated material handling systems, these industry frontrunners can leverage artificial intelligence, machine learning, and cloud computing to elevate operational efficiency and broaden their market footprint.

Which region to offer lucrative growth for the Automated Material Handling Equipment market by 2029?

During the forecast period, Asia Pacific is expected to dominate the Automated Material Handling Equipment market. In addition to that, the region is also projected to be depiciting highest CAGR from 2024 to 2029.

Which product of the Automated Material Handling Equipment market is expected to hold largest market share in the next five years?

ASRS segment to hold largest market share during the forecast period. The growing emphasis on warehouse automation to boost operational efficiency and meet rising consumer demands is anticipated to drive significant adoption of ASRS solutions, resulting in a robust CAGR for this segment in the foreseeable future.

Which Industry of the Automated Material Handling Equipment market is expected to drive the market's growth in the next five years?

Over the next five years, substantial growth in the automated material handling equipment market will predominantly stem from the Automotive sector. This surge is fuelled by factors like rising efficiency and productivity needs, labour shortages and costs, increasingly complex vehicles (including electric vehicles), and the industry's embrace of Industry 4.0 principles. Automated systems like robots and AGVs can streamline assembly lines, optimize warehousing, and enhance quality control. Market estimates predict significant growth in the coming years, with the automotive sector being a major driver. While initial investment costs and workforce skills development remain challenges, the long-term benefits of automation are expected to outweigh them, solidifying automated material handling equipment as a crucial element in future automotive manufacturing.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

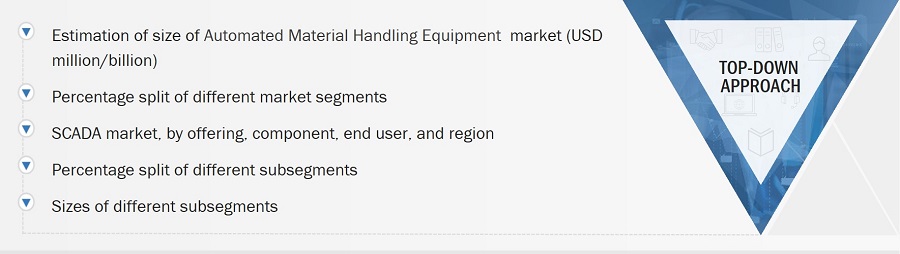

The study involves four major activities for estimating the size of the Automated Material Handling Equipment market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been the validation of these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the Automated Material Handling Equipment market. After that, market breakdown and data triangulation procedures have been used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources referred to for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated through primary research.

Primary Research

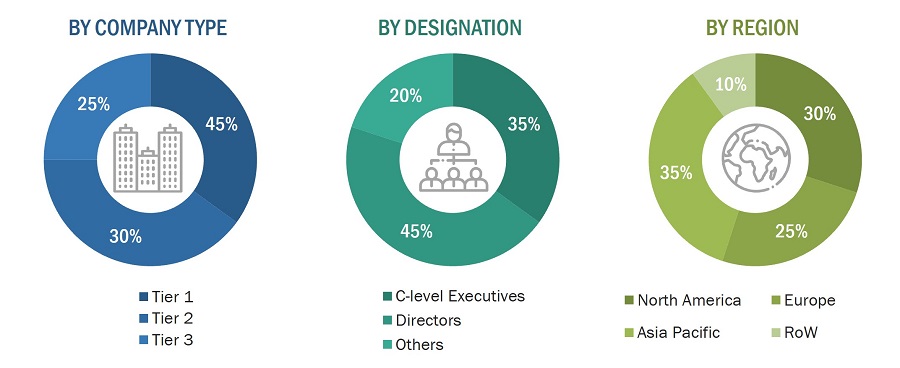

Extensive primary research has been conducted after gaining knowledge about the current scenario of the Automated Material Handling Equipment market through secondary research. Several primary interviews have been conducted with experts from both demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data has been collected through questionnaires, e-mails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

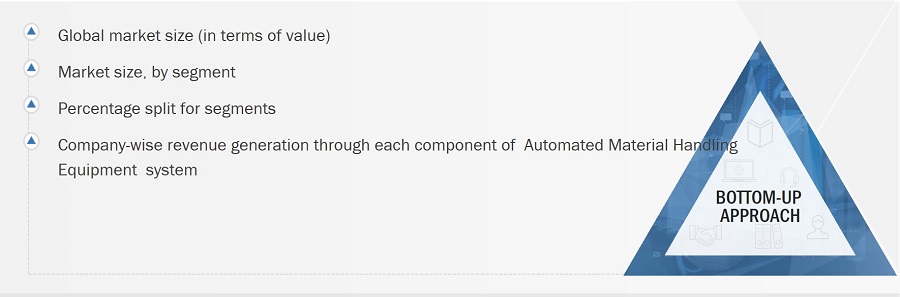

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the Automated Material Handling Equipment market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Automated Material Handling Equipment Market Size: Bottom-Up Approach

Global Automated Material Handling Equipment Market Size: Top-down Approach

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. To complete the overall market engineering process and arrive at exact statistics for all segments, the market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Market Definition

Automated material handling equipment serves as integrated systems for the efficient handling and storage of materials across various stages of product manufacturing, warehousing, and distribution processes. These systems are designed to regulate material flow within manufacturing facilities while prioritizing safety, timely delivery, and cost-effectiveness. Examples of such equipment include automated guided vehicles (AGVs), automated storage and retrieval systems (ASRSs), cranes, robots, warehouse management systems, and conveyors and sortation systems.

Stakeholders:

- Integrators of material handling systems

- Warehousing companies

- Government bodies, venture capitalists, and private equity firms

- Manufacturers of automated material handling equipment

- Research organizations, forums, alliances, and associations

- Software and service providers

Report Objectives:

- To describe and forecast the automated material handling equipment market in terms of value, segmented based on product, system type, and industry

- To forecast the market size, in terms of value, for four main regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To describe the software and services provided for automated material handling equipment and outdoor material handling equipment

- To provide the latest trends in warehousing technologies that are impacting the automated material handling equipment market

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To analyze the probable impact of the recession on the overall market as well as the regional recession impact in the future

- To provide a comprehensive overview of the value chain of the automated material handling equipment ecosystem

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market positions in terms of ranking and core competencies, and provide a detailed competitive landscape of the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for this report:

- Company Information: Detailed analysis and profiling of additional five market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automated Material Handling Equipment Market